Riding on corporate profitability growth and raised salaries, net collection through direct taxes touched nearly 81 per cent of the Budget Estimate during April 1-January 10 period of the current fiscal, Income Tax Department said on Thursday. Given this trend, collection is expected to exceed the Budget target by ₹80,000-9,0000 crore.

Direct tax collection target for current fiscal is ₹18.23-lakh crore. Direct taxes include corporate income tax (CIT) and personal income tax (PIT).

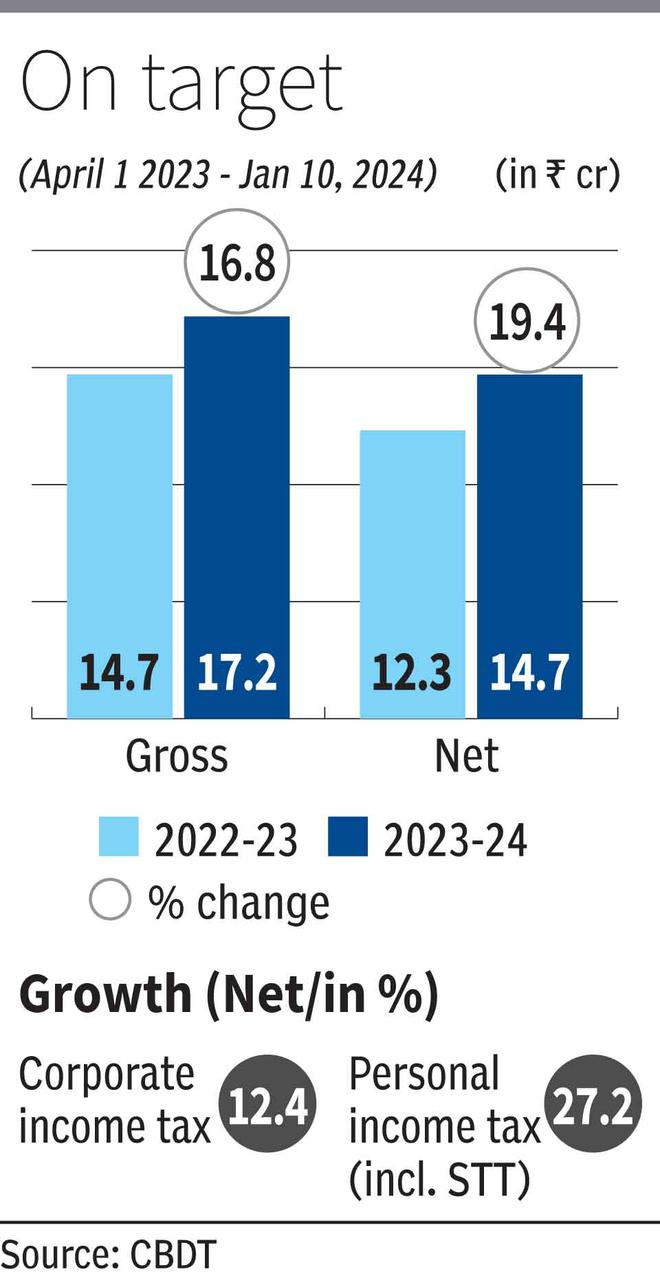

A statement issued by Central Board of Direct Taxes (CBDT) said that direct tax collection, net of refunds, stands at ₹14.70-lakh crore, which is 19.4 per cent higher than the net collections for the corresponding period of last year. This collection is 80.6 per cent of the total Budget Estimates of direct taxes for FY24. “The provisional figures of direct tax collections up to January 19, 2024, continue to register steady growth,” the statement said.

During the period under consideration, gross collections are at ₹17.18-lakh crore, which is 16.8 per cent higher than the gross collections for the corresponding period of last year. Refunds amounting to ₹2.48-lakh crore have been issued during April 1, 2023, and January 10, 2024. After adjustment of refunds, the net growth in CIT collections is 12.4 per cent and that in PIT collections is 27.2 per cent (Including Securities Transaction Tax or STT).

Earlier, CBDT Chairman Nitin Gupta had said that direct tax collection will surpass the Budget Estimates of ₹18.23- lakh crore during FY24. “We will exceed the Budget target. The economy is doing well and we will get a better picture of full-year tax collection once the third instalment of advance tax numbers come in by December 15,” Gupta had said.

Advance collections

Provisional figures of total advance tax collections for FY24 (as on December 17) stand at ₹6.25-lakh crore against ₹5.21-lakh crore for the corresponding period of the immediately preceding financial year (i.e. FY23), a growth of around 20 per cent. These collections are of three instalments June 15, September 15 and December 15) and comprise three fourth of total tax payable.

Commenting on collection, Gouri Puri, Partner with Shardul Amarchand Mangaldas & Co, said this the government’s multi-pronged approach to formalise the economy. Increasing digital data sources through third party reporting under TDS and TCS etc. also seems to have contributed to higher compliance and direct tax collections, she said.

Sumit Singhania, Partner with Deloitte India, said the shift to new tax regime for individual taxpayers has been instrumental in encouraging voluntary compliances. “At the same time, corporate tax collections reflect earnings growth as well as enhanced tax reporting on the back of more sophisticated taxpayers’ data triangulation. Both trends will continue to show the way for government to continue the tax reforms in the coming years too.,” he said