Bengaluru-based IT major Infosys recorded sequential revenue and profit decline in the third quarter. The company has also tightened revenue guidance, as it remains bogged down by seasonal weakness and continued damp demand environment amid uncertain macro conditions.

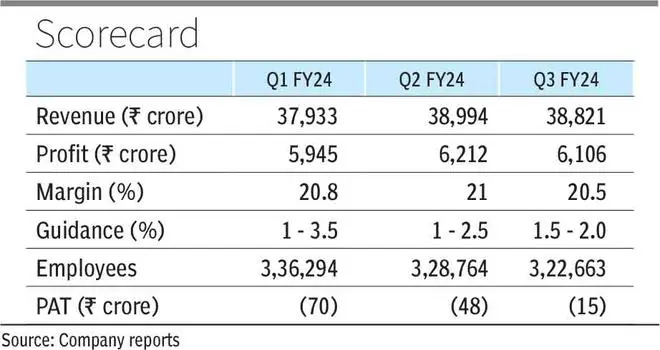

The net profit for the quarter stood at ₹6,106 crore, a 7.3 per cent decline year-on-year (YoY). On a quarter-on-quarter (QoQ) basis, profit dipped 1.7 per cent from ₹6212 crore last quarter. Revenue from operations rose 1.3 per cent YoY at ₹38821 crore. Sequentially, revenue marginally decreased by 0.4 per cent. While revenue fell in line with market expectations, profits were a miss.

Infosys’ outlook for the rest of the year remains soft as it has narrowed its guidance from 1-2.5 per cent last quarter to 1.5- 2 per cent. Salil Parekh, CEO and MD, said, “As we get closer to the end of the financial year, we have tightened the revenue growth guidance, so we see the outlook, in essence, quite similar.”

He added that at this stage, we have not seen any different behaviour from clients, and typically, Q3 is a quarter with large furloughs.’ Digital programs are fewer, while cost efficiency and automation are much more prominent. Additionally, Parekh added that generative AI has garnered a lot of interest and traction.

The total contract value of large deals in the quarter stood at $3.2 billion, with 71 per cent net new additions, lower than $7.7 billion, booked last quarter, where multiple mega deals were signed. The management noted that their earlier wins and present momentum were good indications for the future. The new deal wins are related to cost efficiency, automation, consolidation, SAP rollout, cloud, and other areas across the portfolio.

Operating margins for the quarter stood at 20.5 per cent, marginally lower than 21 per cent last quarter. Margin guidance, however, has been retained at 20-22 per cent. Nilanjan Roy, Chief Financial Officer, said, “This quarter, wage hike had an effect of 70 basis point, and we have had another impact of 30 million between revenue and cost because of the McCamish incident, a 1.3 per cent headwind. We have compensated that with 50 basis points from project maximus which is in full flow, across verticals.”

Headcount

Infosys’ total headcount fell by 6101 employees to 3,22,663, from 3,28,764 last quarter. Voluntary attrition during the quarter fell to 12.9 per cent from 14.6 per cent, last quarter. The IT major also announced a definitive agreement to acquire InSemi, a semiconductor design and embedded services provider, for Rs 280 crore. This is in a bid to strengthen its Engineering R&D capabilities.

Sanjeev Hota, Head of Research, Sharekhan by BNP Paribas, said, “Management commentary future outlook remain stable, without any major change in the demand or margins narrative. We view Infosys Q3 earning as stable in a seasonally weak quarter and expect focus is now shifted to earnings improvement in FY25/26E, as headwinds bottoming out for the sector.”

With inputs from BL Intern Sanjana B