It was a rough year for the market regulator at the Securities Appellate Tribunal, with setbacks in key cases. The tribunal reversed the disgorgement order passed by the Securities and Exchange Board of India (SEBI) in the NSE matter in January last year. The disgorgement order passed by SEBI against Ramalinga Raju and his relatives in the high-profile Satyam scam case, faced a similar fate. Both these orders were set aside by SAT citing the inappropriateness of unlawful ‘gains’ identified by SEBI for the purpose of disgorgement.

“SEBI should relook at the manner in which it assesses unlawful gains or avoided losses for determining the quantum of disgorgement amount. Several such orders have been quashed by SAT or remanded back to SEBI due to the lack of a uniform approach in ascertaining these amounts and reliance on notional values,” said Vaibhav Kakkar, Senior Partner, Saraf and Partners.

SAT quashed the Brickwork Ratings India order cancelling its license and asked SEBI to pass a fresh order on the quantum of penalty. In the Zee Entertainment matter, SEBI had barred Subhash Chandra and his son Punit Goenka from holding any key managerial position in ZEEL and any other listed entity. However, SAT overturned this interim order and stated that SEBI had relied upon presumptions rather than actual proof.

Penalised twice

The regulator was penalised twice by SAT, for initiating enforcement proceedings against the legal heirs of a deceased director of a Sahara entity and for the lackadaisical approach in de-freezing demat accounts of a shareholder in the Kirloskar matter.

The recent SAT decision in the Karvy Stock Broking case, directing SEBI, NSE and NSDL to restore the pledge on securities made in favour of certain lenders, worth about ₹1,400 crore, is another example of a decision going against SEBI. “Some notable cases saw the SAT expressing strong criticism of SEBI, either due to the regulator persisting in issuing orders contrary to established legal principles or acting in a non-uniform manner,” said Sumit Agrawal, Founder, Regstreet Law Advisors. “It’s essential to consider that the constitutionality of delegated legislations and many practices of SEBI are still awaiting resolution by the Supreme Court.”

A recent SC-appointed expert committee in the Adani-Hindenburg matter emphasised the need for SEBI to enhance the effectiveness of its enforcement policy and l a culture of judicial discipline. “Implementing these recommendations is crucial to dispel the perception that SEBI consistently faces setbacks in significant cases,” said Agrawal.

Experts believe that several SEBI orders are not backed by sufficient evidence and come to premature conclusions. “SEBI should look to have direct evidence, build a case not on mere suspicion or technicalities but when it crosses the preponderance of probability. SEBI should follow SAT and SC orders by providing all documents to the litigants and follow principles of natural justice without presuming guilt,” said Anil Choudhary, Partner, Finsec Law Advisors.

Positives

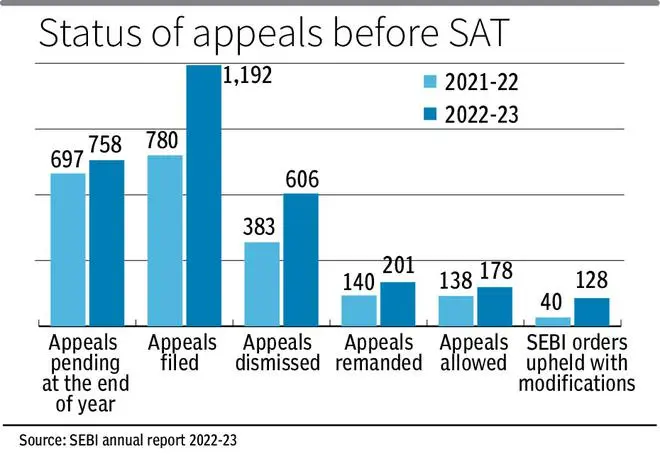

In the larger scheme of things, however, SEBI orders continue to pass muster before SAT. In FY23, for instance, around 53.6 per cent of the appeals filed before SAT were dismissed and only around 15.7 per cent appeals were allowed. This was in line with the appeals disposed of during FY22. “There is nothing to suggest that the same trend will not continue for the current financial year,” said Kakkar.

In the NSE co-location and the dark fibre cases, SAT upheld SEBI’s bar on NSE for accessing the securities market for six months and its order directing NSE to bolster its internal due diligence and audit systems.

There were instances where, instead of outright setting aside the orders of SEBI whole-time members or adjudicating officers, the SAT opted to remand the matters back to them, providing an opportunity for correction of identified infirmities.

In the past, SAT’s presiding officers passed orders commenting on the conduct of WTMs or AOs, copies of which were then sent to the Finance Minister, Finance Secretary, or the incumbent SEBI Chairperson. Such occurrences have largely been absent in recent years, said Agrawal. “It is imperative for SEBI to shift from a policing mindset to fostering a more judicial perspective within its administrative staff. The regulator needs to view the SAT not as an adversary but as a judicial guide in its regulatory endeavours,” Agrawal said.

The pending investigations in the Adani matter may pose a fresh challenge for the regulator and test its relationship with overseas regulators, according to Sidharth Kumar, Senior Associate, BTG Advaya. “Given the global nature of financial markets, collaborating with international regulators and adopting best practices from other jurisdictions can help SEBI improve its regulatory framework. SEBI should also focus on re-considering the criteria of settlement and making it more attractive for reduced litigation,” said Ravi Prakash, Associate Partner, Corporate Professionals Advisors and Advocates.