As a category, multi-cap is a relatively recent entrant to the mutual funds space, as market regulator SEBI’s norms on investment proportion based on market capitalization was announced in September 2020. From early 2021, some older fund houses (Nippon India, ICICI Prudential, Sundaram and Invesco) shifted their existing schemes to the segment with new mandates. Most of the others preferred to roll out new fund offers over the next couple of years.

SEBI rules on multi-cap equity funds state that at least 25 per cent of the portfolio of such a scheme must be invested in each of large, mid and small-cap stocks. The balance of 25 per cent can be invested according to the fund manager’s discretion, and most funds have preferred to use this leeway to add more large-cap stocks to manage risks.

DSP Mutual Fund is the latest entrant with an NFO that opened on Monday and closes on January 22.

Read on to make an informed call about investing in the fund.

What the fund is about

Investments will be made under four buckets – growth, compounders, value and turnaround – each with specific monitorable factors.

The fund can also invest up to 25 per cent of its portfolio in international stocks, as it seeks to invest in businesses focused on innovation that are not currently available in India.

DSP Multicap fund will adopt a bottom-up stock selection process in building its portfolio. It will look at metrics such as return on investment capital, operating cashflows to EBITDA and EBITDA growth. It will also assess the management quality and conduct due diligence on taxes paid, related-party transactions, etc. Valuation will be another key parameter but will be used to evaluate the potential of a stock vis-à-vis addressable market, taking into account the structural or cyclical nature of business.

A broad-market mix

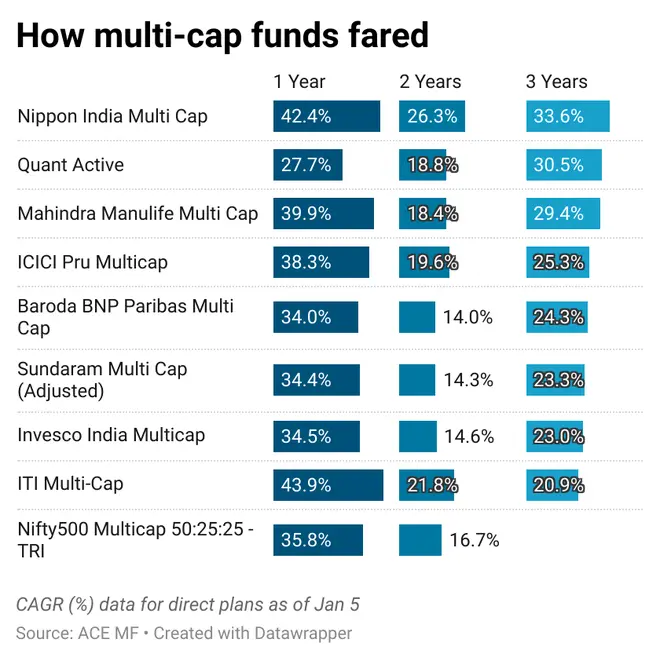

Riding on the small and mid-cap rallies, many multi-cap funds have done quite well in the last few years. Of course, funds have tended to somewhat temper risks by upping the large-cap proportion closer to 50 per cent.

An interesting data point (highlighted in the presentation) emerges based on 5-year rolling returns from April 2005 to November 2023. Over this period, the Nifty 500 Multicap 50:25:25 Index has outperformed the Nifty 500 nearly eight out of 10 times, as a higher mid and small-cap weightage helps it deliver better returns.

Essentially, a multi-cap fund can be a good avenue for an investor not wanting to get into small-cap investing directly and wants some cushion in case of heavy falls.

As such any investments in this category of funds must preferably be done via the SIP route to somewhat protect the portfolio from market volatility and average costs.

What should investors do?

Since the category itself is only about three years old, it is not easy to take a call on multi-cap funds. Flexi cap funds would be better choices for investors with moderate risk appetite.

But for those who can take more risks, the Nippon India Multi-cap fund would be our first preferred choice in the category. It has been a long-term outperformer even in recent years after the new SEBI mandate on multi-cap asset allocation came into being. Quant Active and Mahindra Manulife Multi Cap are other good choices.

Ideally, investors should wait for the DSP Multi Cap fund to develop a track record before taking exposure. However, those still wanting to invest can consider small SIPs in the fund, given the risks involved.