PSU stocks, and within that the Railway PSUs, have had a stellar run on the bourses in the last one year — RVNL (up 155 per cent), Ircon (215 per cent), IRFC (208 per cent) and RailTel (182 per cent) have all been outstanding performers. At bl.portfolio a few months ago, we had recommended to investors to take chips off the table in RVNL and IRFC and lock in on the gains. We now recommend that investors book profits in RailTel.

After giving flattish returns for little over two years post listing in February 2021, the stock gathered momentum mid last year. The entire gains post listing have come from June 2023. Consistent performance, and the buzz around much needed implementation of ‘Kavach’ rail safety systems following the unfortunate rail accident in Odisha in June, gave extra thrust to the stock.

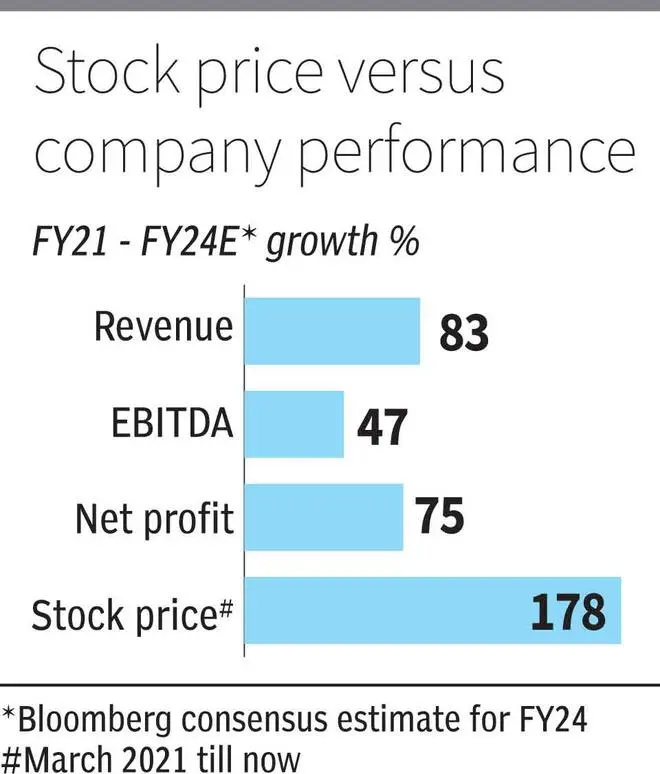

However, the stock may have travelled too far too soon. Trading at 60 times trailing PE as against average since listing of around 23.5 times, the stock has more than adequately factored best case scenarios. While this valuation is very expensive for any company in general given its growth prospects, it is all the more so for PSUs which may sometimes have constraints of balancing profitability versus social good. Post the run up, dividend yield, which is one of the reasons PSU stocks are sometimes favoured, has become unattractive for RailTel with trailing dividend yield at just around 0.5 per cent now.

This is a valuation-based call. New investors interested in the stock can wait for better entry points at some point of time in the future.

Business

RailTel, a Miniratna Central public sector undertaking, is an information and communications technology (ICT) infrastructure provider and one of the largest neutral (carrier-agnostic) telecom infrastructure providers in India. It originally started off as an in-house telecom services provider for Indian Railways. RailTel was later mandated with the task of building and maintaining a high-speed mobile communication corridor along railway tracks to meet the communication needs of Indian Railways.

As part of its contract with the Railways, RailTel also has the ‘right of way’ along the tracks for laying optic fibre cables. When fully implemented, its high-speed optic fibre cable (OFC) backbone network will cover the entire railway network across the country. As of now, its network is spread across all major cities and towns, enabling the company to serve 70 per cent of the country’s population.

Services provided using its network cover leased line, VPN, and enterprise/retail broadband. However, it needs to be noted that while the coverage is wide, the scale as yet is low. For example, the OFC of RailTel spans around 60,000 km as compared to Jio’s 15 lakh km. The company also provides data centre and related services to Railways and other enterprises (mainly PSUs). This, and a few other passive telecom/network infrastructure services, make up the telecom segment of the company which accounted for near 60 per cent of the company’s revenue in FY23.

RailTel derived balance revenue from its projects segment which encompasses ICT hardware/ software and system integration projects for enterprises and also solutions and signalling services for the Railways.

Recent performance

In 1H FY24, RailTel reported operating revenue of ₹1,067 crore and net profit of ₹106 crore — up by 33 per cent and 30 per cent over 1HFY23. In recent quarters, the company has been getting a boost to business from its projects segment, which saw revenue grow by 96 per cent in 1H to ₹466 crore as compared to telecom segment which reported sluggish growth of just 6 per cent.

The outlook for the projects too appears strong with order book at around ₹5,000 crore (although some of it is very long term), and growth is expected to outpace the telecom business strongly in the second half as well. However, one thing to be noted here is that the projects business has lower EBIT margins at around 7.5 per cent (1H FY24) than the telecom business (21 per cent). So, in a case where projects business is driving growth for the company, the earnings growth will be lower than topline growth.

The good performance apart, as mentioned above, the news flows around ‘Kavach’ systems have also added to positive sentiment in the stock as RaiTel is likely to be involved in its implementation. However, the positive sentiment on this aspect is overdone as the opportunity and impact is unquantifiable as of now and there are also uncertainties on how these will play out given the long timelines and intricacies involved.

With the recent surge in shares, the risk reward is unfavourable