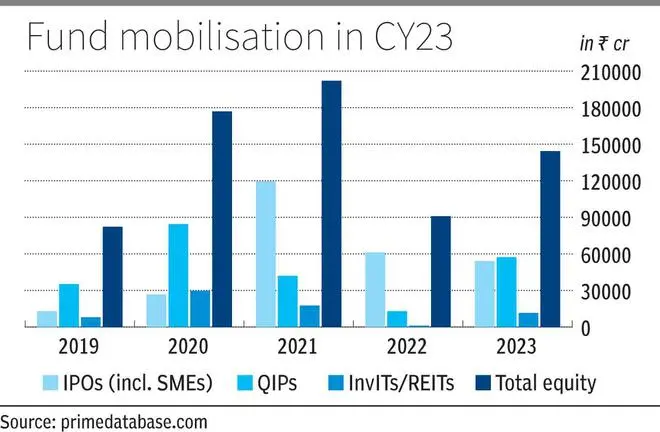

Public equity fund-raising rose 59 per cent to Rs 1.44 lakh crore in CY23, led by 57 mainboard initial public offerings (IPOs) that raised Rs 49,434 crore, and 45 qualified institutional placements (QIPs) that mobilised Rs 54,350 crore, according to primedatabase.com.

The mop-up from QIPs is 363 per cent higher than the Rs 11,743 crore raised in 2022. QIPs were dominated by financial services and engineering companies, with Bajaj Finance raising Rs 8,800 crore, accounting for 16 per cent of the total amount. In addition, the QIPs of Brookfield India Real Estate Trust, a ReIT, and India Grid Trust, an InvIT, raised Rs 2,305 crore and Rs 669 crore, respectively.

The average IPO deal size reduced to Rs 867 crore from Rs 1,483 crore and Rs 1,884 crore in the previous two years. Forty-one of the 57 IPOs were oversubscribed more than 10 times, and 16 more than 50 times.

Eighty-seven companies filed offer documents last year, while 40 looking to raise nearly ₹70,000 crore let their approval lapse.

The average number of applications from retail rose to 13.21 lakh from 5.66 lakh in 2022. The highest number of applications from retail were received by Tata Technologies (52.11 lakhs), DOMS Industries (41.30 lakhs) and INOX India (37.34 lakhs), data from primedatabase.com showed.

The number of shares applied for by retail by value stood at ₹1.49 lakh crore, 203 per cent higher than the total IPO mobilisation. The total allocation to retail was ₹13,749 crore, 28 per cent of the total IPO mobilisation.

The average gain on listing day rose to 29 per cent from 11 per cent in 2022. Of the 57 IPOs, 40 gave a return of over 10 per cent. 53 are trading above the issue price as of January 1, 2024 closing prices, with an average return of 46 per cent.

21 of the 57 IPOs that hit the market had a prior PE/VC investor who sold shares in the IPO. The amount of fresh capital raised was ₹20,662 crore or 42 per cent of the total amount, the highest in seven years. A third of this amount was for capital enhancement/ working capital and a fifth for retirement of debt.

Anchor investors collectively subscribed to 34 per cent of the total public issue amount. Domestic mutual funds played a slightly more dominant role than FPIs as anchor investors, with their subscription amounting to 14 per cent of the issue amount with FPIs at 13 per cent, the primary market tracker said.

Qualified institutional buyers (including anchors investors) subscribed to 57 per cent of the total public issue amount. FPIs, as anchors and QIBs, subscribed to 23 per cent of the issue amount, more than mutual funds at 17 per cent.

Other segments

SME IPOs collected ₹4,681 crore, a record, with Spectrum Talent Management’s ₹99.99-crore offering being the largest one.

Offers-for-sale through stock exchanges (OFS) for dilution of promoters’ holdings, saw a 71 per cent jump last year to ₹19,300 crore. Of this, the government’s divestment accounted for ₹12,016 crore or 62 per cent of the overall amount. The largest OFS was that of Coal India (₹4,179 crore).

The amount raised through InvITs and ReITs rose to ₹11,474 crore from three issues.

A dozen companies tapped the market for rights issues, raising ₹7,266 crore, 87 per cent higher than the previous year.

The public bonds market saw 44 issues raising ₹18,176 crore, while the amount raised through debt private placements stood at Rs 9.65 lakh crore, up 24 per cent from the previous year. Indian companies also raised ₹3.19 lakh crore through overseas borrowings, including ECBs, up 1 per cent from the previous year.

Overall, fund raising by Indian corporates, through equity and debt, rose by 20 per cent to ₹15.13 lakh crore in CY23, from ₹12.60 lakh crore in the previous year.