As a mutual fund investor, it is crucial to understand the turnover ratio and its implications on the overall returns of the chosen fund(s). The ratio indicates the frequency at which the fund manager churns over the complete portfolio. This ratio is more pertinent for the equity and balanced category of funds and not so much for the debt funds.

High turnover ratio

There could be various reasons for a high turnover ratio ranging from the active management style to betting on cyclicals, riding on short-term opportunities and global factors leading to a change of outlook towards a sector. However, it is important to note that high churning/turnover might not necessarily lead to higher returns and it can only be known in hindsight.

A higher turnover ratio, without a significant outperformance compared to the benchmark and its peer funds, is counterproductive; on one side, it leads to higher brokerage costs which can reduce the overall returns, and on the other side high churn also indicates a lack of conviction of the fund manager towards constructing a strong portfolio which can deliver over for the medium to long term.

As an equity unit-holder, one needs to keep an eye on the portfolio turnover ratio and be sure that a rise in the portfolio turnover ratio is not accompanied by a poor performance of the fund. If the trend persists, then it is a matter of worry.

What the data says

An analysis of turnover ratios of 200+ equity fund schemesacross categories presented some interesting insights:

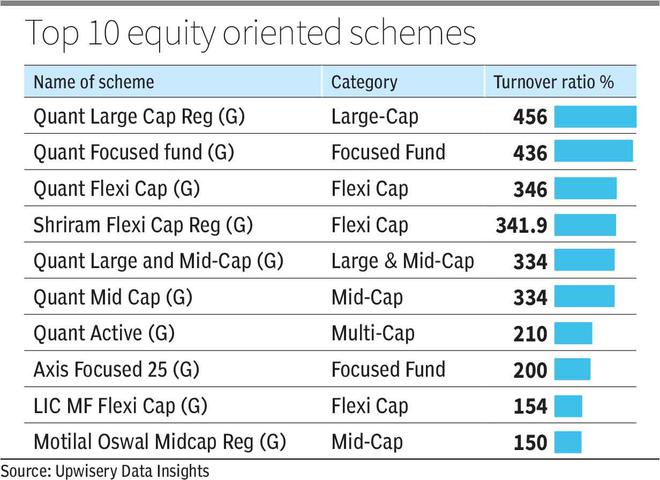

If we look at the top 10 funds based on the ranking of turnover ratio, it represents a diversified mix from flexi-cap, focused, large- and mid-cap categories. The high turnover ratio depicts that the fund houses follow an aggressive investment style and churn portfolio quite actively; the style seems to be working for them so far, as most of the schemes have been able to deliver category-leading return on a five-year rolling return basis (as on October 31, 2023).

Higher turnover ratio = Higher Alpha in the short term

From the data set, we can conclude that active management leads to Alpha generation in the short term, but the returns start to converge over a longer duration. Hence a constant high turnover ratio is more suitable for investors with high risk appetite. The same trend has been seen in the case of mid-cap and flexi-cap space.

Focused funds

Focused fundsshowed a different trend as the top performers for different time zones had lower turnover ratio compared with schemes with higher turnover for one-, three- and five-year rolling. Here, the top two performers had a turnover ratio of 3 per cent and 18 per cent funds as against the higher turnover ratio of 436 per cent and 116 per cent ranked fourth and sixth respectively over a five-year rolling return basis.

As AUM increases

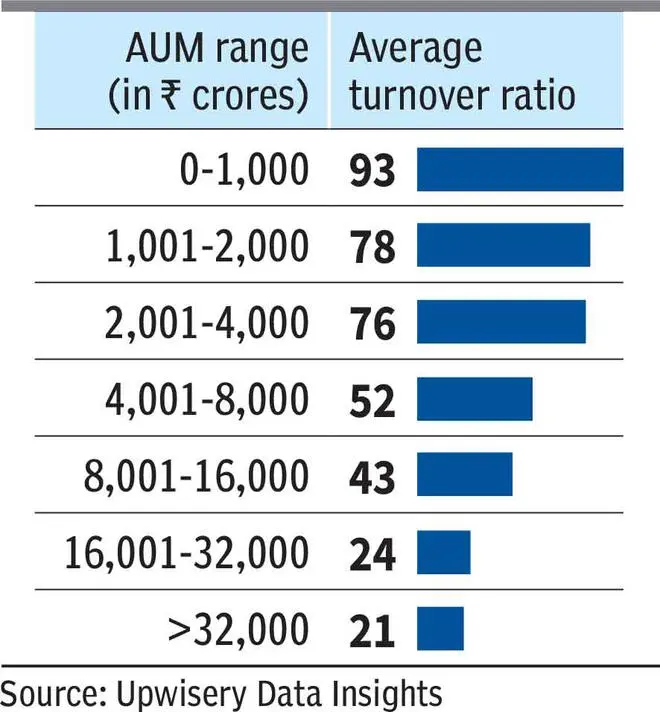

As AUM increases, turnover ratio decreasesas the increase in AUM leads to spreading over of brokerage expenses over a larger corpus (as shown in the table below, where for every incremental slab, there has been fall in the Turnover ratio). We can infer that in the initial stages, funds with lower AUM provide fund managers with more freedom to churn the portfolio; but at a large scale, options to deploy large chunk of capital becomes challenging and hence the composition is more towards stable companies and for longer holding periods.

Quant leads the pack

As of October 31, 2023, the highest Turnover ratio was witnessed for Quant Mutual Fund. The ratio ranged from 456 per cent for the large-cap regular plan to 140 per cent for the small-cap fund.

From the above table, we see a representation of six schemes from Quant Mutual fund in the top 10 list.

If we analyse the return profile of the category (small-cap), we see that barring Quant small cap, the top five have an average turnover ratio of 16.62 per cent with an average five-year rolling return of 19.59 per cent (as against 140 per cent and 23.01 per cent respectively for Quant Small cap). The returns tend to be even higher for Quant small cap for one- and three-year rolling.

Caution is key

We have two aspects to keep in mind while looking at the turnover ratio of schemes. On one side, we can say that a higher turnover ratio can work against the investor returns as there are numerous costs involved — transaction charges, statutory charges and even missed opportunities — to name a few.

On the other side, if at a high turnover ratio the fund manager’s management style is accompanied by higher returns, the same is acceptable; however, an investor has to keep a close watch on the returns as during bullish market conditions, funds have been observed to outperform even when the turnover ratio is high.

The real test comes when the markets are flat or bearish. Here, it becomes critical to keep the portfolio turnover under a tight leash.

The author is Partner and Co-Founder, Upwisery Private Wealth