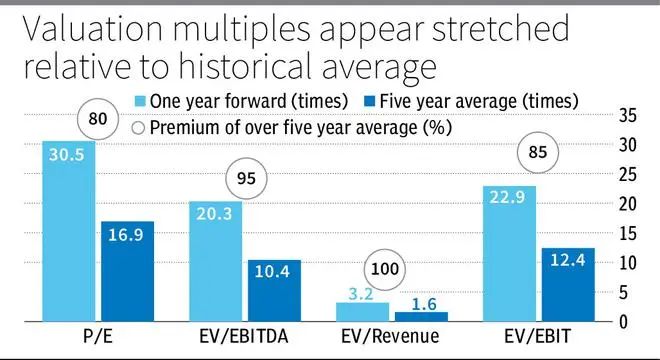

The stock of Birlasoft is up nearly 200 per cent from its lows of ₹250 in April this year. The upside has been driven by a combination of turnaround in business, after margins were hit in FY23 and EBITDA/net profit declined 18/29 per cent. With FY24 performance so far reflecting improving operating performance, the valuation of the stock has re-rated from trailing PE of 21 times in April to trailing PE of 55 times now. Even factoring for the turnaround continuing, the stock now trades at a one-year forward PE of 30.5 times as against 5 year average of 16.9 times.

At current levels, the risk-reward is not favourable any more for the following reasons. For one, stock is already reflecting prospects of improved performance and solid execution over the next few years. Birlasoft, like many other companies in the sector, was a beneficiary of the Covid-induced digitisation boom that resulted in multi-bagger returns in the small/mid-cap IT services spaces.

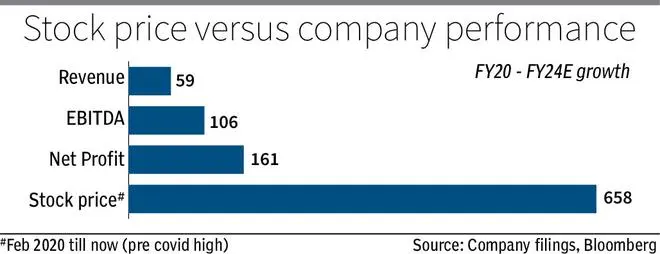

From a pre-Covid level (February 2020) of around ₹95, Birlasoft is up 658 per cent. During the same time, its revenue, EBITDA and net profits are up by 59, 106 and 161 per cent. This implies market is already factoring high growth prospects over the next few years. In this backdrop, there are a few risks that are not reflected, leaving the stock with low margin of safety.

Although the company is actively looking to diversify its geographic exposure, for now North America accounts for a significant 85 per cent of revenue. While the US has managed to surprise with solid growth in 2023, the risks of inflation and recession in 2024 remain as of now. Till there is clarity on this, high-valued IT services stocks are vulnerable to significant corrections if a recession materialises.

Hence, we recommend that investorsbook profits in Birlasoft and lock in on the sizable gains delivered this year. This is a valuation call.

Business and recent performance

As a well-established mid-tier IT services company, Birlasoft has strong presence across four verticals — Manufacturing (41 per cent of revenue), Life sciences (24 per cent), BFSI (21 per cent) and Energy & Utilities (14 per cent). Its relatively higher exposure to manufacturing and lower exposure to BFSI is a differentiator versus many peers in the sector. High-growth digital and cloud-related business accounts for around 58 per cent of revenue (comparable with Tier 1 peers) — up from around 30 per cent in 2020.

After a strong FY22, the company faced delays in ramp-up of deals that impacted revenue and a few execution issues, including higher hiring costs that impacted margins. This, combined with broader cautious outlook for the entire sector, resulted in the stock correcting from a peak of around ₹575 in January 2022 to ₹250 in April 2023.

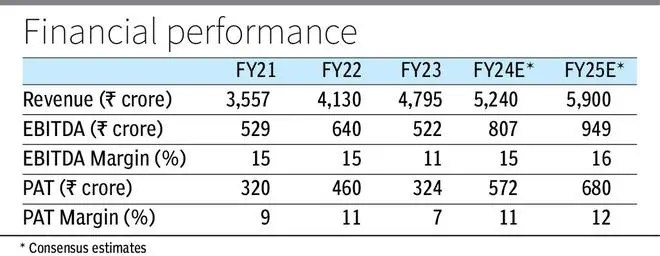

However, the company’s performance has improved after the hiccups, with good recovery in the first two quarters of FY24. In the recently concluded Q2, Birlasoft delivered revenue of ₹1,309 crore (up by 10 per cent Y-o-Y), EBITDA of ₹207 crore (up 17.5 per cent) and net profit of ₹145 crore (up by 26 per cent). Constant currency revenue growth was at 6.4 per cent.

These results are good, especially when compared with the weaker performance of many top-tier IT companies in FY24. However, the stock rally since April appears to factor best case scenario, which comes with risks.

Consensus estimates now imply a 12 per cent growth in revenue in FY25 and 18 per cent growth in earnings. This will require the current economic momentum in the US to sustain. Further, the rupee has been flattish versus the dollar for the entire year. If this continues, after a while it can start impacting margins negatively for IT services companies. Mid-tier IT services companies with lower EBITDA margin than top-tier players can be susceptible to higher impact on net profits when margins shrink (ie a 1 per cent decline in margins will have higher impact on a company with lower margins than one with higher).

As mentioned above, this is a call based on valuation and risks not factored. Not factoring the risks is what resulted in the over 50 per cent draw-down in the stock between January ‘22 and April ‘23. Existing Investors need to take cognizance of current risks and can lock in on the gains.

Investors who have remained on the sidelines so far can wait for better entry points in the future.