Infrastructure, capital goods, realty, public sector undertakings (PSUs) were on fire in 2023, with indices tracking some of these sectors/themes rising a by over 50 per cent up to even 80 per cent this year. The year 2023 as well as much of the post-Covid period has thus seen a thumping return of many of the neglected segments of the past decade.

Thematic and sector funds, we are often told, are risky and require a reasonable strategy for entry and exit. And often, small lump-sums are suggested during market dips to make the most of your investments.

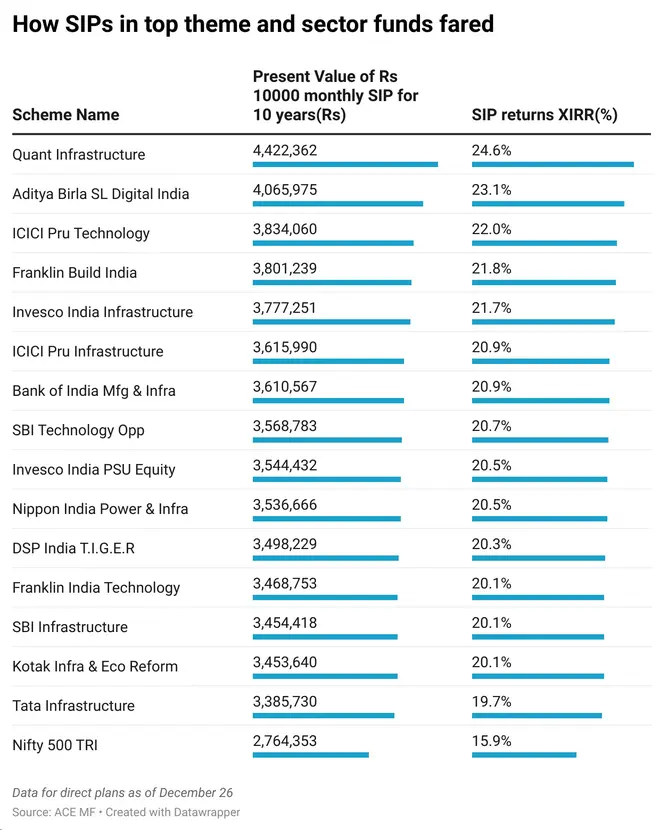

While these observations are fairly true, a bl.portfolio analysis reveals even SIPs (systematic investment plans) in select thematic and sector funds over a long-term of 10 years has been rewarding.

Consider this. Of the 59 thematic and sector funds with a track record of a decade or more, as many as 43 schemes (more than 70 per cent) outperformed the Nifty 500 TRI on a 10-year SIP basis (2013-2023). And the top 15 funds in terms of returns (XIRR) delivered nearly 20 per cent or more over the 10-year period.

Infrastructure leads the pack

For the analysis, we took all the 59 funds that fall into various themes or sectors. The returns via SIP mode (XIRR) between December 2013 and December 2023 – 120 monthly instalments – are considered.

Infrastructure was the overwhelming topper with as many 10 of the top 15 funds in terms of returns coming under this theme. After years of underperformance, sub-segments within the infrastructure theme – power, construction, logistics, railways and the like – bounced back strongly from the post-Covid period. As stocks in the theme traded at low valuations, and mostly remained in declining or sideways mode, accumulation of units at lower prices would have worked wonders. The broader market rally from mid-2020 meant that the subsequent gains were substantially large.

Infrastructure funds from the houses of Quant, ICICI Prudential, Invesco India and Franklin India were among the best, notching up about 21-24 per cent returns (XIRR).

One PSU fund – from Invesco India – also figures in the top 10 list. Given the stupendous run in PSU stocks in 2023 and over 1-2 years prior to that, this fund has caught on the trend and made up for the underperformance earlier, with a solid 20.5 per cent SIP returns over a 10-year period.

Tech on top, despite 2023 downturn

The IT and Teck indices gained just 18-25 per cent in 2023. But thanks to its solid performance in earlier years, as many as three of the top 10 funds were from this theme, with increased digitization, adoption of Artificial Intelligence, high usage of OTT and data being key factors. Some of these technology funds also invested in overseas stocks, mostly in the US. Given the excellent run that technology stocks had in the US over the past decade, these funds benefitted from the rally.

Aditya Birla Sun Life Digital India, ICICI Prudential Technology and SBI Technology Opportunities were the top funds in the segment.

The laggards

In a rather tough period for the banking and financial services sector, the 2013-2023 period was marked by rising non-performing assets, then the non-banking financial services crises and COVID related issues. Over the last couple of years, while bank balance sheets have improved considerably as corporates deleveraged, NPAs reduced, and the capital situation improved substantially, funds have remianed laggards, tracking the theme. The BSE Bankex clocked just 11 per cent gains in 2023.

Despite the auto sector having a good run in 2023, transportation and logistics funds, did not fare that well on the SIP returns front over the past 10 years, as the automobile and ancillary sub-segments were laggards till about a couple of years ago.

Pharmaceutical stocks underperformed due to pressure on pricing, increasing USFDA observations and heavy competition. Funds tracking the sector and the broader healthcare theme lagged the broader markets barring the period just after the COVID-19 onset.

What should investors do?

While SIPs for the longer term of 10 years seem to work even for many thematic and sector funds as seen above, these funds must not account for more than 5-10 per cent of your equity portfolio. Use them as diversifiers, and not as part of your core portfolio.