“Not only does God definitely play dice, but he sometimes confuses us by throwing them where they can’t be seen’

That was legendary physicist, the late Stephen Hawking, on why predicting the future is impossible. Yes, there could be exceptions to this rule like ‘Paul the Octopus’, but time and again it has been proven humans fail miserably when they attempt to predict the future. If you aren’t convinced, just look at what was predicted by economists and market participants for the year 2023, — and how different it actually turned out to be.

At the start of the year, the US Fed expected the GDP of the world’s largest economy to grow at just 0.5 per cent. Consensus of economists/analysts was leaning towards a recession. As we stand today, the US is expected to close the year with a GDP growth of 2.6 per cent!! That’s as far away from recession as the Earth is from the Sun. In India too, the growth has surprised to the upside. Across the board, whether India or the US or many other countries, predictions of rate cuts did not materialise. These are just a few examples amongst many.

Markets had to deal with these as well as many other ‘out of the blue’ events that played out during the year. But like the unstoppable force that can uproot even ‘immovable objects’, markets across the world, including in India, defied expectations of even the bulls. As the year nears a close, here’s looking back at some defining market events of 2023 and what we can learn from them.

1) The ‘Big Short’

Short selling is not widely prevalent in India. But in the developed markets, especially the US, for decades, short sellers have placed long-term bets shorting companies, broader markets — as engrossingly chronicled in the international best selling book, The Big Short, and widely successful movie of same name — and even the housing market.

In India, such strategies are not easy to execute and the only common way to do it is via the F&O market, which is limited to just 185 stocks and major indices. Here too, it is limited by time horizon and short sellers will have to keep rolling over positions. In such a market, the report by short seller Hindenburg on Adani came like a bolt out of the blue. While this wasn’t the first instance, with reports by Veritas against a few Indian companies in the previous decade, this was the first time there was a market shaking impact.

The Hindenburg report was enough to sour sentiment across the board in India, with Nifty 50 being the only one among large economy indices turning red in the first two months of the year, clocking a fall of around 5 per cent.

Of course, looking back, this turned out to be just a blip in Nifty’s YTD rally of 17 per cent. But then, nothing spread like fear, and concerns on Adani group’s leverage and potential domino impact on markets and economy, which appears far-fetched now, spooked many. Adani Group stocks, of course, bore the brunt — falling in the range of 30 to 80 per cent by end of February.

2) Banking crisis

Markets began 2023 with an hangover from the fastest hiking cycle by the US Fed. The Fed Funds rate had moved from zero to 4.5 per cent (highest level since 2007) in 2022. While such level of hikes had been implemented in the 1980s, those were from a much higher base when the Fed Funds rate was already in high single or low double-digit percentages. Given the starting base here was zero, the hikes of 2022 count as the most severe hikes in terms of intensity. While most market participants were optimistic, some macro watchers were expecting something to break due to the impact of the rate hikes.

So that something broke was not a surprise when Silicon Valley Bank folded up in early March. That its domino effect, within days, sunk one of the largest and iconic global banks — Credit Suisse — was also not a surprise. After all, when Bear Stearns had collapsed exactly 15 years back in the March of 2008, its ripple effects went on to sink Lehman, which in turn sunk AIG, paralysing the global financial system. But here again, it was quite remarkable how swift action by Central Bankers (although they can be faulted for not pre-empting it) calmed market’s nerves quite quickly.

Unprecedented actions by the Swiss National Bank throwing a lifeline, supplied just about sufficient liquidity to Credit Suisse to survive till the weekend. As uncertainty prevailed, this brought to fore the memories of the weekend of September 13-14 of 2008, when regulators tried to arrange for takeover of Lehman by Merrill Lynch, but what actually happened was Merrill Lynch sold itself to Bank of America (to avoid its own bankruptcy) over the weekend, while Lehman filed for bankruptcy on the morning of September 15.

But having learnt from past mistakes, the regulators pulled their might together this time around over the weekend to ensure Credit Suisse got absorbed by UBS. According to the Swiss regulator, this helped avoid a ‘financial crisis’ worldwide.

The banking crisis reminded us that sometimes bankers never learn the lessons. Whether it was SVB or US Fed, both were caught napping, and the incident was a big embarrassment to the US Fed for not being alert to financial vulnerabilities and the regional banking crisis.

The peak of the banking crisis towards end-March, and market turmoil it caused, marked the bottom for the India stock markets in 2023 with the Sensex and Nifty 50 registering their lows of 57,085 and 16,828. They have returned 24 and 26 per cent respectively since.

The global financial system fortunately managed to stave off a financial crisis in 2023. But are the underlying structural problems solved? We shall know only in 2024.

3) Nvidia and the AI Gold Rush

ChatGPT was launched in 2022. But 2023 was truly the year when AI theme got global attention. The inflexion point was in May 2023 when the semiconductor GPU company, NVIDIA delivered its Q1 (April ending) results and Q2 outlook in what is termed as the ‘greatest beat of all times’. Its market cap increased by $200 billion or the equivalent of an entire Reliance Industries in a single day after this result. Its Q1 results in which revenue beat expectations by 10 per cent, was overshadowed by the 52 per cent beat in its Q2 revenue guidance. Such a beat versus expectations is unprecedented.

A veteran tech analyst at Morgan Stanley, Joseph Moore, noted that he had never seen a quarter like this in the 25 years that he has covered stocks. One Wall Street analyst termed it the ‘guidance for ages’, while another noted that the Nvidia results are a reminder that ‘we are in an AI gold rush.’ Even the most bullish analyst and investor was taken by surprise. This was the signal (crystal) that the AI theme had arrived.

This inflection point replaced the near decade long popular FAANGM theme with new trendy Magnificent Seven (NVIDIA, Microsoft, Alphabet, Amazon, Meta Platforms, Apple and Tesla) – companies that are at pole position in the AI boom. Although not all of them, including companies like Apple, have laid out a clear AI road map, markets seem to be convinced.

Here is an interesting titbit — until a few weeks back when the broader US markets started participating in the market rally, the entire upside in S&P500 of around 20 per cent for the year was driven by the Magnificent Seven; ie the S&P 493 was flat for the year! Such has been the impact of the AI wave! The Mag7 stocks are up in the range of 55 to 242 per cent for the year, with an average return of 115 per cent!

India too was a beneficiary of the AI wave as the positive sentiment buoyed markets globally, especially the tech stocks. The Nifty IT which had been in brutal bear market for over a year after peaking in January 2022, got some extra legs from the AI wave, although the impact to business model of IT services companies is unclear. Some new companies also had successful IPOs by adding the AI jargon to their line of businesses.

4) Return of the Bond Vigilantes

‘If something cannot go on for ever, it will stop’ – this is known as the Stein’s Law in economics and Bond Investors learnt it the hard way in 2023. Globally in the previous decade, bond investors in developed economies had earlier enjoyed a great run as zero interest rate policies and quantitative easing suppressed bond yields and increased the value of the bonds. In fact, in the US, the risk free 30-year government bond index had outperformed the S&P 500 in the period between 1988 and 2020. It’s quite something when a risk free asset outperforms a widely popular equity index for as long as three decades. As the multi decade bond bull market gave way to pressure from high inflation and Fed rate hikes, bond investors endured much pain and volatility in 2023.

High yields had triggered SVB collapse. However, post the banking crisis, it appeared the yields had peaked as recession fears resulted in investors flocking to safe haven of US bonds.

In hindsight that turned out to be head fake. The US 10-year bond yield had peaked at 4 per cent just before the banking crisis in March and collapsed to near 3 per cent in April. But from there it rallied all the way to 5 per cent by October. Across US, Europe and Japan, bond yields spiked to decade-level highs if not more (16-year high in the US). This was enough to roil global equity markets as well, including in India, which came under pressure in October/early November.

While bond yields have cooled off since in anticipation of interest rate cuts next year, 2023 will be known as the year when Bond Vigilantes (bond investors who keep a vigil on inflation and fiscal deficit trends) awoke from their comatose state after dovish Central Banks had neutralised them in the earlier decade.

Plan for possibilities, not certainties, in 2024

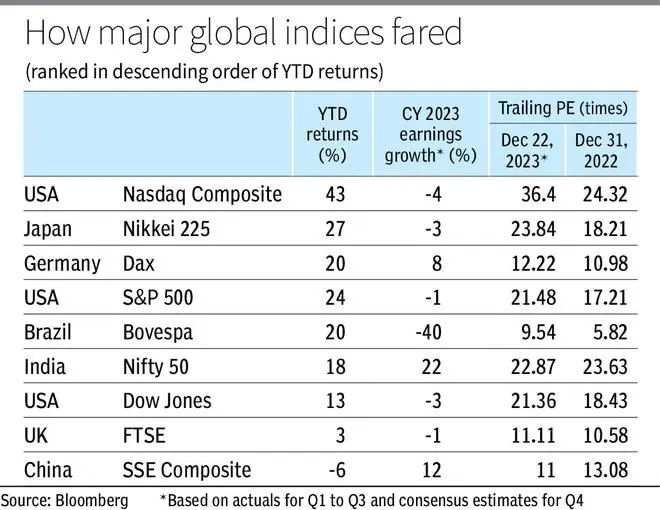

Amidst the many twists and turns in 2023, most major global indices churned healthy returns (see table). But here too there were surprises. The Nifty 50 and the Nasdaq standout. Nifty 50 delivered the best earnings growth by a wide margin. But Nifty 50 wasn’t the best performing index. Nifty 50’s PE multiple shrank marginally this year, reflecting a more fundamentally sound performance.

The Nasdaq Composite, which is tech-heavy and growth oriented, outperformed every major index by a wide margin. High interest rates and equity valuations are inversely correlated as it increases the discounting rate of future cash flows. Besides, increased borrowing costs can impact profit margins. Typically growth stocks tend to get disproportionately impacted by higher interest rates as they are valued based on earnings well into the future, impacting their present value in a high interest rate environment. However, the Nasdaq Composite defied this, seeing a PE multiple expansion in the hope of better earnings growth in 2024. Thus, 2023 was a year where hope and optimism trumped current fundamentals. During volatile 2023, things shifted from consensus view of US recession at start of year to a fiery debate now on whether recession is delayed or derailed. Hence a lot in 2024 will depend on how inflation and interest rates trend. If the hopes of 2023 are belied, this could create challenges for markets in 2024. But 2023 has taught us not to make foolhardy predictions. So best to plan for possibilities rather than certainties.