The frenzy around small caps is high, even though the, rally in the space over the past year has been swift, leaving investors with little valuation comfort. Retail investors must seek to lower their portfolio risks by diversifying to other segments.

Large caps have seen improved traction and, together with midcaps, can give a healthy blend of risk-adjusted returns over the medium to long term.

From a mutual fund perspective, the large & midcap funds category offers a relatively attractive proposition. Market regulator SEBI requires such funds to invest at least 35 per cent each in large and midcap stocks. The remaining 30 per cent can be suitably decided by the fund manager.

In this regard, Mahindra Manulife Large & Midcap Fund (Earlier called Mahindra Manulife Top 250 Yojana) has been a top-notch and consistent performer in the few years it has been around. The fund’s inception was in December 2019, and it is just a few days shy of completing four years of existence.

Investors with an above-average risk appetite can consider the fund for the long term and use the SIP route for exposure.

Strong outperformer

From inception, Mahindra Manulife Large & Midcap has generally been in the top quartile of funds in the category.

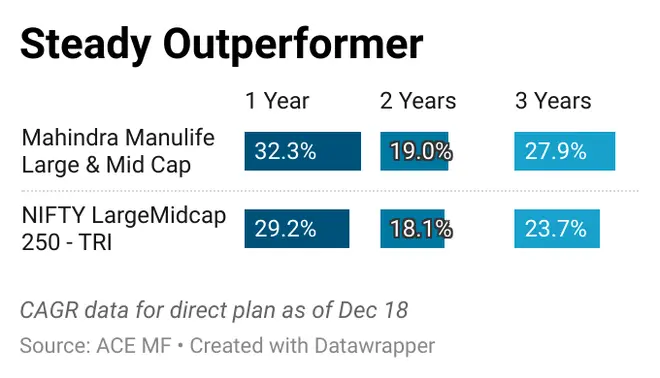

On a point-to-point returns basis over the past one, two and three-year periods, the fund has outperformed its benchmark, Nifty Large Midcap 250 TRI, by 1-4 percentage points.

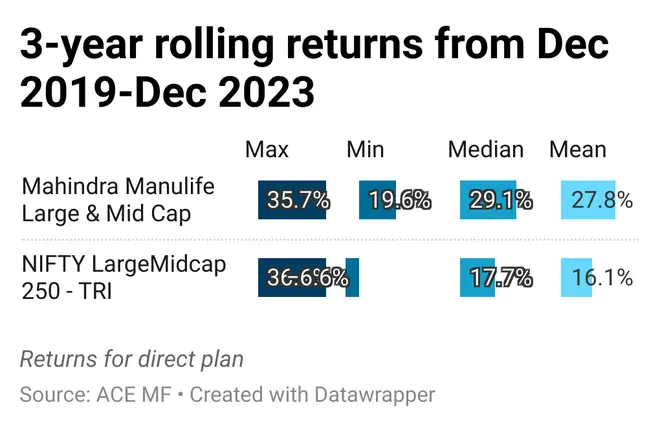

When 3-year rolling returns over December 2019-December 2023 are taken, the fund has outperformed its benchmark over 83 per cent of the time, among the best in its category.

Further, Mahindra Manulife Large & Midcap fund has delivered more than 20 per cent returns nearly 98 per cent of the time on a 3-year rolling basis over 2019-2023. It has given more than 18 per cent all the time (100 per cent) in this period.

The mean returns on a three-year rolling basis over December 2019-December 2023 is a healthy 27.8 per cent. The Nifty Large Midcap 250 TRI managed about 16.1 per cent over the same period.

When SIP returns over the past nearly four years are taken, the fund has managed an XIRR of 27.4 per cent, according to Valueresearch data, placing it among the top couple of funds in the category.

The fund has an upside capture ratio of 109.9, indicating that it rises much more than the benchmark Nifty Large Midcap 250 TRI during rallies. Its downside capture ratio is 100.3, suggesting that the fund’s NAV falls almost as much as the benchmark during corrections. A score of 100 indicates that a fund performs in line with its benchmark.

Healthy portfolio mix

As such, the fund takes a fairly consistent stand on its key sector holdings across timelines. A blend of value and growth styles is visible. Over the past three-odd years, it has consistently held financial services as its top segment. However, the fund plays the sector mostly with mid-tier banks, insurance companies, fintechs and asset management companies. So, Canara Bank, IDFC Bank, HDFC AMC, MCX, LIC and Max Financial Services figure prominently. It also holds PSUs in its top stock holdings, with NTPC and Coal India – value and dividend-yielding picks – figuring in the top 10.

Information technology, capital goods, and oil & gas are other prominent sectors the fund holds.

The sector and stock holdings are quite diffused, and thus, the fund is quite diversified. None of the top 10 stocks account for even 5 per cent of the portfolio as per the latest November 2023 factsheet.

In terms of market cap allocation, Mahindra Manulife Large & Midcap fund used to have a roughly 50:40:10 proportion in terms of large, mid and small-caps, respectively, in the portfolio.

However, in recent months, the fund has also upped stakes in small-caps. T latest portfolio holds 40.7 per cent in large caps, ditto with midcaps and as much as 18.5 per cent in small caps.

This has helped the fund outperform quite well by taking advantage of the broader market rally over the last one year.

Investing in the fund with a time horizon of 7-10 years, at least via the SIP route, may be advisable for those seeking broader market participation via a single fund with the comfort of significant large-cap holdings.