While the need for investors to diversify beyond US equities is a topic that is more celebrated than studied, there are five reasons why sifting fact from fiction can result in better investment outcomes.

First, over one-third of companies’ revenues in the S&P500 index are derived outside the US. The S&P500 index is well diversified geographically and is hardly an American index. It is a global index.

Second, there is a perception that the GDP of the US tends to grow slower than the rest of the world, given its size. World Bank statistics, however, suggest that America’s share of world GDP has remained at 25 per cent over the last three decades. At least in this one non-trivial respect, America has always been great.

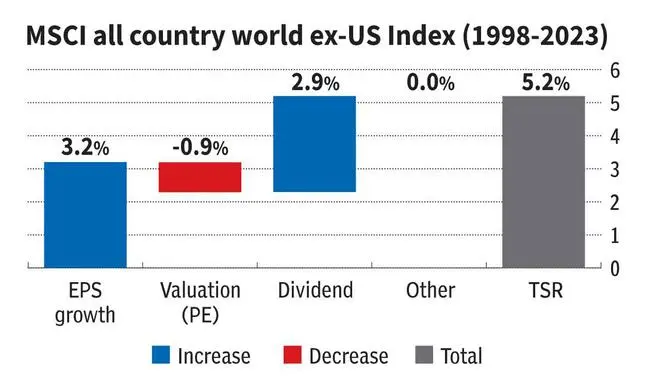

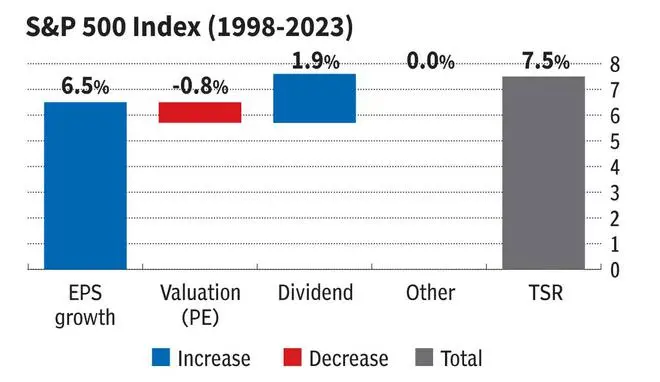

Superior earnings growth

Third, there is a belief that growth in profit generated by global non-US companies will outpace the growth of US companies, given low penetration levels in several emerging markets such as China and India. Over the last 25 years, however, US companies have grown earnings per share twice as fast as global non-US companies. Not surprisingly, the outperformance in shareholder returns over the last 25 years – totaling 200 basis points per annum – has occurred primarily due to differences in profit growth between US and global non-US companies.

Fourth, there is a deep conviction that the valuations of global ex-US companies are cheap because they trade at a 30 per cent discount to the US companies. However, a look under the hood suggests that the return on capital generated by American businesses is also 30 per cent higher than that of global non-US companies. Indeed, one should analyze valuations and return ratios in conjunction before arriving at conclusions.

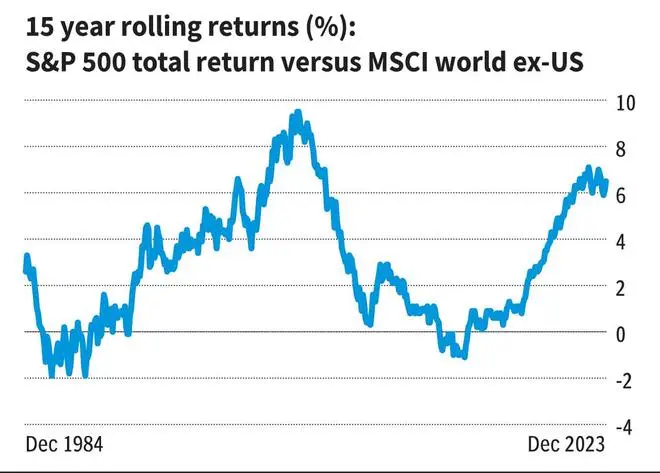

Fifth, capital allocators have unbreakable confidence that investment performance is cyclical. The theory goes as follows: several years of outperformance is usually followed by several years of underperformance, much like how night follows day. The reality, however, is that the S&P 500 index has outperformed the global ex-US index 86 per cent of the time over any 15-year rolling period since 1969.

The right approach

Then, how should investors seeking global exposure outside the US approach international diversification, given that very few financial professionals have an investment horizon greater than 15 years?

First, from a cyclical perspective, the extent of the performance of the US companies over global ex-US companies at the current 6 per cent per annum over the last 15 years has yet to be sustained, as shown in the chart above. If there was ever a time to look outside the US, it is now.

Second, if an investor is not confident of outperforming the global ex-US index by at least 300 basis points per annum, one should not invest internationally, despite recent US outperformance. This is because, on an average, one would need this additional return to beat the S&P500 index over extended periods.

Third, the only way to beat the global ex-US benchmark by more than 300 basis points annually is to buy only the best global companies outside the US. Owning more than 30 names would be a mistake because there aren’t that many great companies of size and significance outside the US. In contrast, global ex-US funds that hug the benchmark or excessively diversify into hundreds of names will never be able to beat the S&P 500 index over extended periods. Nor will country funds or emerging market funds which have offered terrible risk-adjusted returns over time.

One caveat is in order. A top decile performing global ex-US fund that would have returned 300 basis points per annum over the global non-US index over the last 15 years would have still trailed the S&P500 index by 300 basis points per annum. Patience, remember, is the ability to wait without experiencing anger, anxiety, or frustration.

Portfolios that own only a select group of businesses outside the US, that can grow earnings faster than the S&P 500 companies, generate 20 per cent return on capital, wield sustainable free cash flow margins over 20 per cent, and trade at reasonable valuations versus the S&P 500 index will make up for past underperformance. After all, the S&P 500 index has gone through 10 years of negligible returns in the decade between 2000 and 2010.

In conclusion, investors seeking diversification into equities outside the US should identify funds that invest in only a small set of outstanding companies combined with a low portfolio turnover and a track record of investment excellence. Without such discipline, an S&P 500 index fund would be an excellent alternative. In other markets, challenges relating to currency, corporate governance, competitive intensity, and the inconsistent implementation of the rule of law - all of these combine to hurt corporate profit growth and long-term investment returns

While there are many ways to lose while investing outside the US, there is only one clear way to win. Invest in 30 blue-chip international companies, buy right, and sit tight. Gift City will see the introduction of one such product in 2024.

The author is Founder & Chief Investment Officer, Lyptus Capital