The past 18-24 months have been rather unique for Indian markets. Both equities and bonds have been quite volatile over this period as inflation rates rose, geopolitical tensions increased and Central Banks hiked interest rates to record levels.

Frontline equity indices, despite gyrating continuously, are at near-record levels. While there may be limited comfort in the overall markets, select pockets are attractive. Yields on bonds are at high levels, making fixed income products an interesting proposition, though yields may be peaking out as inflation comes under control and growth pangs hit economies, especially the advanced ones.

Given this scenario, whether to invest in equity, debt or the sentimental gold this Diwali may not be an easy decision for investors. If you are looking to deploy your Diwali bonus or incentive somewhere, mutual funds, which invest in a mix of asset classes, present a good opportunity. These funds make the cut for three reasons: One, the fund manager decides the asset allocation based on market conditions. Next, these funds lend themselves to both lump-sum and SIP investing as asset allocation removes the challenges associated with timing market entry. Finally, the sheer variety on offer caters to investors of varying risk appetites.

Here are four fund categories you can invest in for Diwali — aggressive hybrid, balanced advantage, multi-asset allocation and conservative hybrid.

Aggressive hybrid funds

These funds are mandated to invest 65-80 per cent of their portfolios in equity and related instruments and 20-35 per cent in debt securities.

In practice, such funds tend to have 65-75 per cent investments in equities and the rest in debt.

Why: In markets where equity valuations offer little comfort and where high interest rates offer a chance to lock into attractive accruals in fixed-income instruments, a blend of the two with an aggressive tilt to equity may be just right for new and young investors. As such, funds determine asset allocation based on strong internal valuation models, hence there is a certain degree of comfort while investing in them.

Suitability: Aggressive hybrid funds may suit investors with an above-average risk appetite looking for attractive returns over the long term.

Typically, an investment horizon of five years or more may be able to deliver robust returns to investors, with limited downside.

Earmarking investments in such funds for goals that are 5-7 years away may work to your advantage.

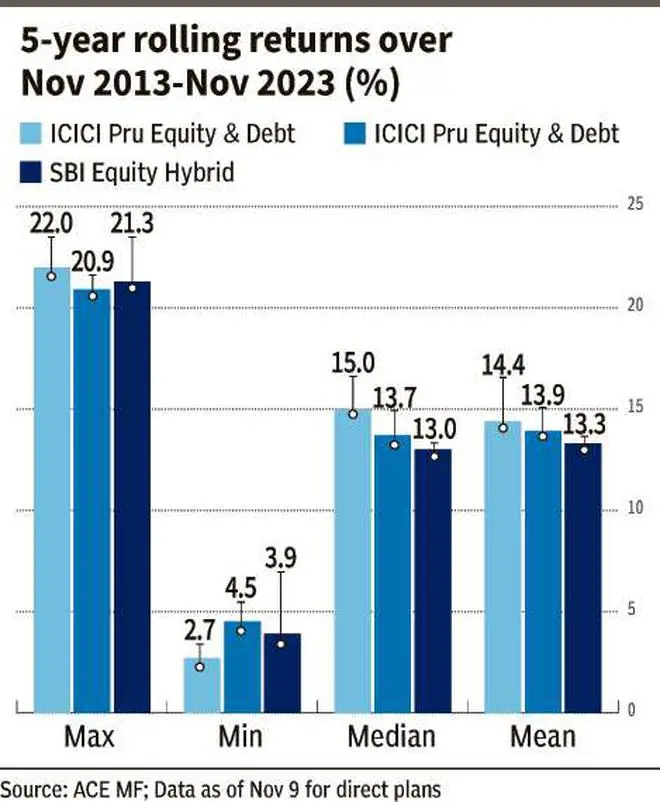

Best funds:While choosing the best funds in the category, we look for those with a long track record of 10 or more years. We took the five-year daily rolling returns over November 2013 to November 2023.

ICICI Prudential Equity & Debt, Canara Robeco Equity Hybrid and SBI Equity Hybrid are three funds you can consider for investing your bonus this Diwali. While the ICICI fund has delivered in excess of 12 per cent over 76 per cent of the times over the above-mentioned 10-year period on a five-year rolling basis, the Canara Robeco fund managed to do so more than 74 per cent of the times. The SBI fund exceeded the 12 per cent threshold around 61 per cent of the times.

Since these are aggressive hybrid funds, a return threshold of 12 per cent was set.

These funds are mostly large-cap oriented in the equity portion, though some venture into mid and small-caps as well. But due to the diffused holdings, risks are somewhat lower. They take fairly safe bets on the debt side.

Balanced Advantage Funds

In the midst of market uncertainties and upcoming state elections results, investors seeking stability and also part of potential equity upside may find Balanced Advantage Funds (BAFs) a compelling option.

Compared to pure equity funds, these hybrid products offer a blend of equity and fixed income investments along with a dash of derivatives, helping them dynamically tweak their asset allocation based on market conditions to mitigate volatility and potentially enhance returns.

Why: BAFs play a crucial role in protecting your portfolio from significant losses during market corrections. They achieve this by hedging equity exposure through derivatives and debt, reducing overall portfolio volatility.

The specific mix of debt, derivatives, and unhedged equity is determined by each fund house’s valuation models, ensuring a tailored approach for each fund.

BAFs generally fall into two broad categories:

Counter-Cyclical: These funds reduce equity allocation and increase fixed income or hedging when equity valuations are high, effectively reducing risk in overheated markets. They increase equity exposure when valuations are attractive, aiming to capture market upsides.

Pro-Cyclical: These funds take a different approach, aiming to maximise returns during bull markets while protecting downside during bear markets. They increase equity allocation in rising markets and reduce it in falling markets, potentially benefiting from sustained upward trends.

Suitability: BAFs are suitable for investors with varying investment horizons, from one year to very long tenures:

For 1-3 years: BAFs provide a more compelling alternative to pure debt funds, offering exposure to equity while mitigating downside risk. They can be used alongside pure debt funds to diversify risk.

For 3-5 years: BAFs can be an effective addition to a portfolio of debt funds and flexi-cap funds, offering both stability and potential returns. They align well with risk profiles seeking balanced growth.

For 5+ years: BAFs can be a valuable tool for investors with aggressive risk profiles and long-term investment goals. They allow for lower debt allocations while still mitigating volatility, enhancing potential returns over time.

BAFs that maintain an equity exposure of at least 65 per cent qualify for equity taxation, potentially offering tax benefits. While they cannot completely replace debt allocation, they can reduce debt requirements and enhance overall tax efficiency.

BAFs emerge as a prudent choice for investors seeking to navigate market volatility while potentially capturing equity upside.

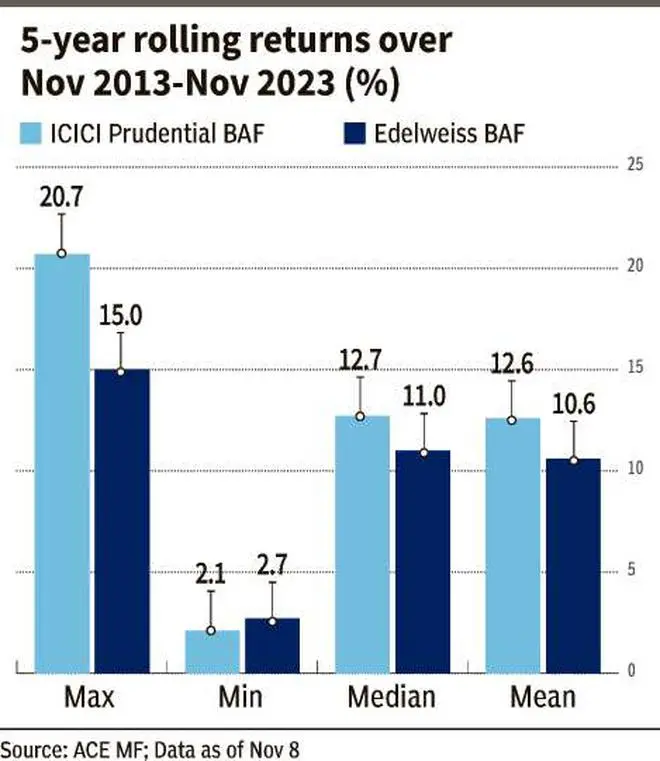

Best funds: We prefer two funds with different approaches. Edelweiss Balanced Advantage is a scheme with a pro-cyclical approach. ICICI Prudential Balanced Advantage, a pioneer of the BAF category, is known for its success with a counter-cyclical framework.

Both schemes have beaten their category and respective benchmarks in trailing 3, 5 and 10-year periods. They have been able to limit downsides during bad phases while capturing decent upsides, given their mandate during upswings. Importantly, both Edelweiss BAF and ICICI Pru BAF have outperformed peers in 1-, 3 and 5-year rolling returns for the last 10-year period (ended November 8, 2023) with controlled volatility.

Note that the ICICI Pru offering is more adept at limiting downsides, while the Edelweiss BAF is better at reflecting upwards market moves. So, choose your pick as per your risk profile, or a combination of two.

Multi-asset allocation funds

If you want to add a bit of gold to your portfolio on Diwali for sentimental reasons, multi-asset allocation funds are an option. To qualify as a multi-asset fund, a minimum of 10 per cent investment is required in at least three asset classes. Eligible categories encompass domestic and international stocks, fixed income/debt, and commodities (such as gold and silver). Some funds may also include Real Estate Investment Trusts (REITs), commodity derivatives, and arbitrage.

Why: Augmenting a portfolio with asset classes exhibiting either no correlation or negative correlation results in a genuinely diversified basket. The diverse mix is crucial for unlocking the desired return enhancement compared to other hybrid options. Different fund houses employ various models, guiding asset allocation based on fundamental, technical, or a combination of factors.

Although multi-asset allocation funds as a category are relatively young (emerging since 2018) and thus have a limited track record, available data indicates that they have experienced a decline of only 30-50 per cent during downturns in the last 1- and 3-year periods. Concurrently, returns in the multi-asset category have been nearly as robust as those in aggressive hybrid funds for the same periods but with lower volatility.

Suitability: Multi-asset allocation is an integral part of any portfolio-building strategy. Investing in a multi-asset fund means entrusting not only the selection of individual assets but also the overall asset allocation strategy to the fund.

These offerings are ideal for longer time frames. For investors already holding aggressive hybrids or dynamic asset allocation/balanced advantage funds, multi-asset funds with a third asset class like commodities can mitigate the impact of poor performance on the overall portfolio.

Multi-asset funds serve as a suitable testing ground for low-risk investors exploring equities cautiously, those sensitive to equity drawdown impact and seeking the stability of multiple assets, and individuals requiring a single product for medium to long-term wealth creation on autopilot.

Best funds: There are two main types of multi-asset funds: equity-oriented and debt-oriented. The latter, a recent development capable of delivering low-volatility fixed-income-like returns, provides debt scheme taxation benefits with indexation.

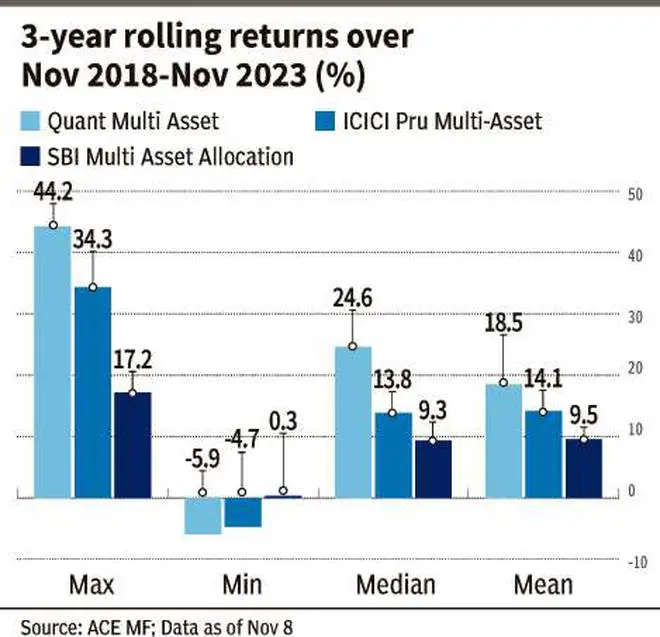

While some funds were newly launched, others transitioned to this category from a different basket. Despite a potentially long track record, these funds likely had a different strategy or portfolio before 2018 when SEBI initiated the MF recategorisation exercise.

Our fund recommendations lean towards a long track record, active management (excluding fund of funds), and differentiated/large investment teams due to the complex interplay of multiple asset classes.

For those prioritising lower volatility over returns with less aggressive equity exposure, SBI Multi Asset Allocation stands out as a preferred choice. For those seeking higher equity allocation in the multi-asset space, ICICI Pru Multi-Asset and Quant Multi Asset emerge as solid options based on their performance records (refer to the table). In terms of equity exposure, Quant appears to demonstrate greater dynamism.

Conservative hybrid funds

Not all investors want to go the whole hog on the equity side of things. Many investors would still want to be heavy on debt investments, with a small touch of equities so that they generate above-average returns. Market regulator SEBI’s mandate requires conservative hybrid funds to invest 10-25 per cent of their portfolio in equity and equity-related instruments, while 75-90 per cent must be parked in debt securities. Most were MIPs (monthly income plans) earlier that re-badged themselves as conservative hybrids when SEBI’s reclassification norms kicked in.

Why: Given the debt-heavy nature of these funds, they tend to deliver steady returns over the medium term.

The recent tax changes — removal of indexation as well as the distinction of long and short terms while calculating gains — may have taken some sheen off debt funds and even conservative hybrid schemes.

Nonetheless, quality conservative hybrid funds can help generate inflation-beating returns even on a post-tax basis as some of them have managed double-digit returns over the medium to long term.

Most conservative hybrid funds hold 15-25 per cent in equity and about 70-75 per cent in debt. Some funds have large-cap focus in their holdings, while others take a multi-cap approach. But irrespective of the market cap bias, the holdings are highly diffused and diversified, making for a moderate risk equity portion. The debt side is filled with G-Secs, corporate bonds, NCDs, certificates of deposits that are rated AAA and AA. The debt side has low credit risk and minimal interest rate risk for most funds.

Thus, the blend of equity and debt makes for a simple low-risk portfolio.

Suitability: Conservative hybrid funds suit newbie and low-risk investors who seek a mostly debt-driven portfolio, but want a mild kicker in returns via equities. The best of these funds can beat inflation even on a post-tax basis over the medium to long term.

Investors looking to save for medium-term goals that are 3-5 years away and do not want too many risks can invest lump-sums or even take the SIP route. These funds can also be used to lower equity exposure, yet remain invested, by switching when you are closer to a goal.

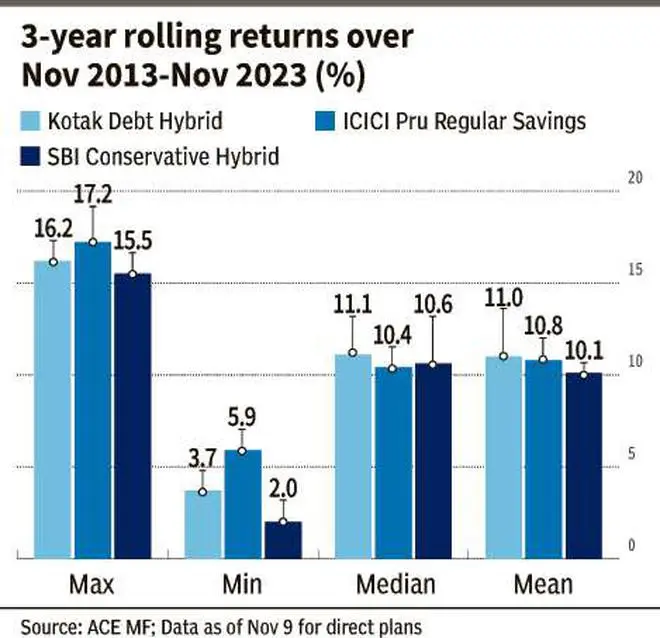

Best funds: We zero in on three funds based on their three-year daily rolling returns over the past 10 years (November 2013-November 2023).

Over this 10-year period, ICICI Prudential Regular Savings, Kotak Debt Hybrid and SBI Conservative Hybrid have delivered more than 10 per cent mean returns on a three-year rolling basis.

These funds have delivered more than 10 per cent returns 55-62 per cent of the time in the above-mentioned timeframe and rolling period.

ICICI Prudential Regular Savings has a large-cap bias and in its debt portfolio has an average maturity of more than 5 years. SBI Conservative Hybrid and Kotak Debt Hybrid have a multi-cap approach to equities and bet on the longer end of the debt curve with average maturities extending to 8-9 years or more.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.