As all central banks have raised rates rapidly since 2022 to fight inflation, the RBI has also been moving in tandem. It has raised the policy repo rate by 250 basis points since May 2022, taking repo rates from 4 per cent to 6.50 per cent. But, as the RBI Governor admitted in the recent monetary policy meeting, transmission of the current cycle of rate hikes is not complete.

The transmission this time has, in fact, been higher in deposits than in loans.

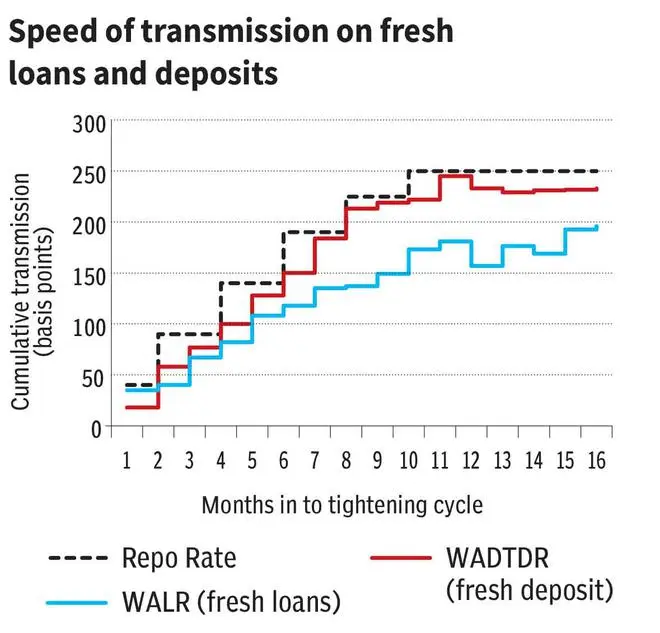

Weighted average domestic term deposit rates (WADTDR) on fresh deposits of retail and wholesale borrowers have increased by 224 basis points. This is understandable, as banks have needed funds to meet the rapid credit growth over the past year.

The overall increase in lending rates has, however, been much lower than deposit rates. There has been an 184 basis point increase in the weighted average lending rate on fresh rupee loans of all banks.

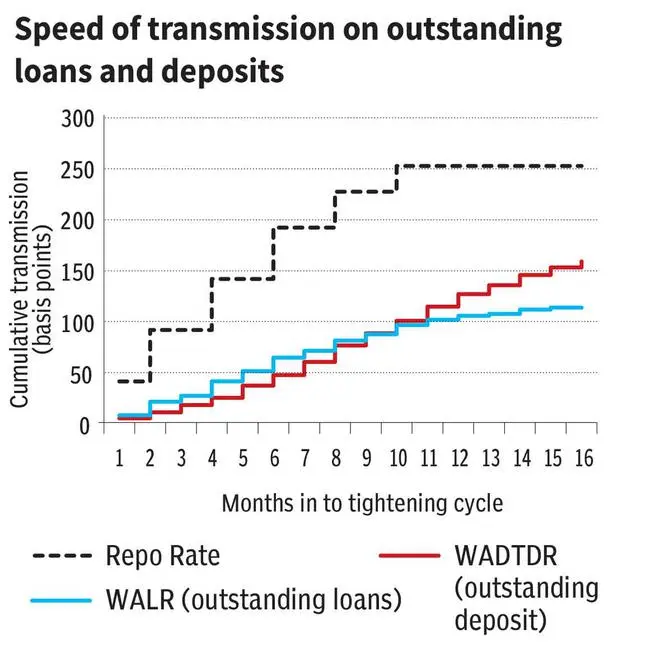

The increase in the lending rate of existing loans has been much lower, at just 110 basis points.

Partial to large depositors

Interest rates on fresh term deposits have almost entirely priced in the increase in policy rates, as seen in the adjacent graph.

While outstanding deposits have not priced in the increase completely, as existing deposits mature and are rolled over at higher rates, this will begin reflecting in WADTDR for outstanding deposits too.

Given the tight liquidity conditions, competition for deposits is likely to increase among banks, placing savers in a sweet spot with the possibility of rate increase even exceeding 250 bps in some banks.

Also read: Lenders bank on the festival spirit, offer high savings rates

But banks seem to be rewarding larger depositors more than smaller ones. Interest rates on fresh retail deposits have registered a much lower 168 basis point increase.

Lower transmission in loans

How have banks managed to increase rates on deposits while keeping lending rates low?

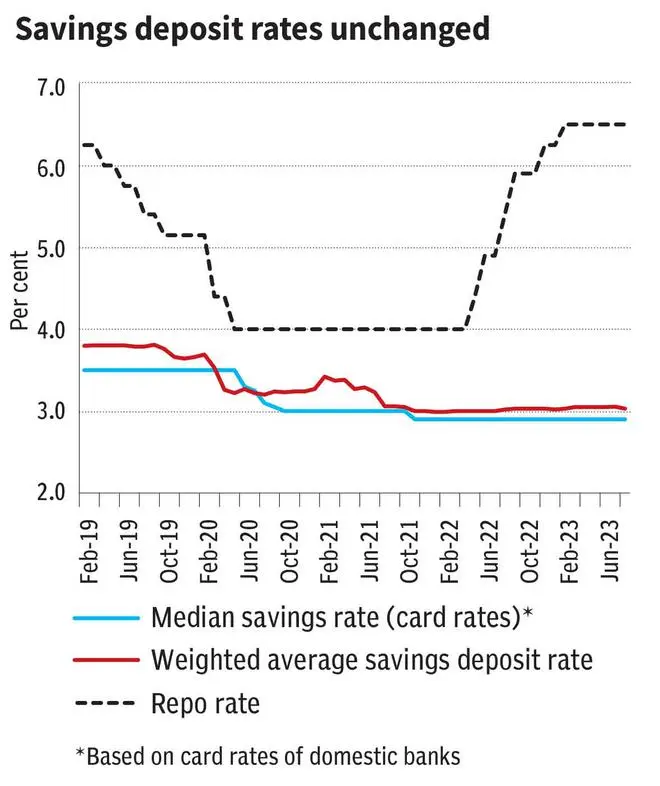

This has been possible with the help of CASA deposits (current account and savings account). The rate of interest on savings accounts, which account for one-third of bank deposits, has not changed at all in this cycle.

Current accounts, which have 9.6 per cent share in total deposits, do not give any interest. This has given banks room to keep lending rates low. This is why most banks have been reporting stellar profit numbers over the past year, despite the rising policy rates; the net interest margins of banks have continued to be healthy due to this reason.

Two, increasing competition for incremental credit may have made banks wary about increasing loan rates too sharply in some segments.

As the adjacent chart shows, rates have gone up for industry and for personal loans, but rates on housing, vehicle, and education loans have been kept lower.

Also read: HDFC Bank: Regaining premium valuation, a daunting near-term task

Finally, a large proportion of loans are still linked to the marginal cost of funds-based lending rate (MCLR). This rate is calculated based on the deposit rate, repo rate, operational costs of the bank, and the cost involved in maintaining the CRR. The transmission is slower in loans linked to the MCLR as it is contingent on many other factors. Around 44.8 per cent of deposits as of June 2023 were still linked to MCLR.

The other option of pricing loans – EBLR (external benchmark linked loan rate), results in immediate resetting of the loan rate once the policy rate moves. These loans will account for 50.2 per cent in June 2023. Transmission will become much faster as the proportion of EBLR loans increases.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.