One of the offshoots of the interest rate increases announced by the RBI over the past year or so has been that the yields at the shorter end of the curve rose sharply. Indeed, the 182-day and 364-day treasury bills traded at fairly high yields for much of 2022 and early part of 2023, before dipping a but over the past couple of months.

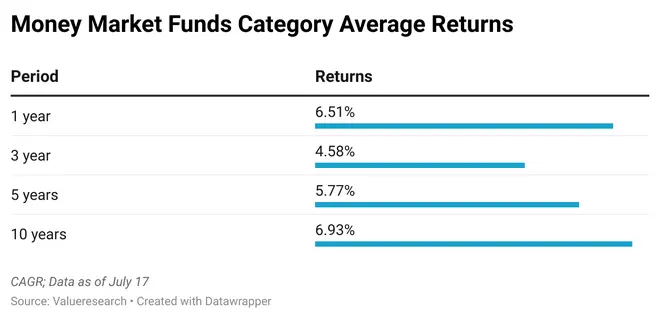

And funds that invested in the shorter maturities did fairly well over the last one year, with many money market funds giving more than 7 per cent return in this period.

Money market funds – much like liquid and ultra-short-term schemes – are meant primarily for the short term, with the safety of capital and reasonable, even if low, returns being the priority.

The newest asset management company Bajaj Finserv is rolling out a money market fund and the NFO is open till July 20.

Also read: Bajaj Finserv AMC files papers for launching seven NFOs

Here’s what you must know before investing in money market funds.

Low-risk funds

Money market funds are mandated by SEBI to invest in securities that mature within a year. Typically, these funds invest in treasury bills, short-term commercial papers, government of India securities, and certificates of deposits.

Typically, these bonds carry the highest short-term rating of A1+ or are sovereign. Therefore, there is hardly any credit risk while investing in these funds.

In the past year or so, the shorter end of the yield curve shot up significantly. Both the 182-day and 364-day treasury bills saw yields going past 7 per cent. The peak in the 364-day treasury bill’s yield was over 7.3 per cent in March 2023, while for the 182-day treasury bill, it was 7.28 per cent in March 2023. That was the time when the rate hike cycle was still in effect and there were a couple of large bank failures in the US, which hurt sentiments and brought in risk aversion, thus pushing up yields across the board.

Of course, over the last few months, yields have cooled off and these treasury bills now trade at around 6.8-6.9 per cent levels.

Also read: Bajaj Finserv banks on tech, last-mover advantage to make its mark in MF biz

One-year commercial papers and one-year certificates of deposits are trading with yields of 7.48 per cent and 7.33 per cent, respectively, according to data from Kotak Mahindra Mutual fund. These are down about 17-25 basis points in the last three months, but still significantly up from last year.

As a result of the yield spike, money market funds did well and many delivered more than 7 per cent return in the last year. Typically, these funds had average maturity of 3-10 months.

What should investors do?

As far as the interest rate cycles are concerned, the consensus is that the cycle is close to its peak. But given that inflation, though largely under control, does see spikes once in a while, as seen last month due to food price increases. Therefore, rates may not be cut any time soon. Though yields are softening slowly, there may not be a dramatic fall, even in the shorter end of the curve.

The recent finance bill delivered a blow to debt funds by removing indexation benefits and taking away all definitions of short and long-term relating to holding periods.

This is all the more a reason to stick to established funds that deliver reasonably well without taking any undue risks. In the debt category, the more seasoned funds are safer.

HDFC Money Market, Aditya Birla Sun Life Money Manager, Nippon Life Money Market, and SBI Savings are among the better funds in the category and have delivered well over the past several years.

Investors can wait for Bajaj Finserv Money Market Fund to develop a reasonable track record over the next few years before taking any exposure.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.